Our Group

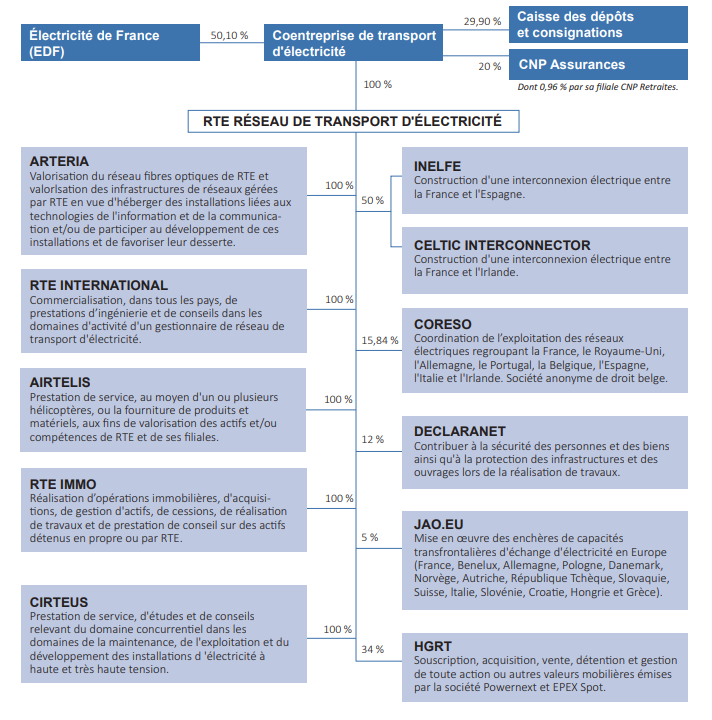

Chart of the CTE group of companies as at March 1, 2025

RTE Réseau de Transport d’Electricité

RTE Réseau de Transport d’Electricité is the operator of the French electrical power transmission network which it also owns, maintains and develops. As such, it principally performs the following three functions:

- manages power flows: RTE Réseau de Transport d’Electricité is responsible for the supply/demand balance and makes adjustments, manages electricity flows and manages access rights to international interconnections, in collaboration with neighbouring network operators. It mobilizes reserves and compensates for losses. It makes the necessary accounting adjustments and resolves imbalances;

- manages the transmission infrastructure: RTE Réseau de Transport d’Electricité operates and maintains the public transmission network and is responsible for its development, for minimizing costs for the community and for ensuring the safety of the system, people and property; and

- guarantees access to the transmission network: RTE Réseau de Transport d’Electricité enters into contracts with transmission network users on the basis of network access tariffs and in accordance with rules of non‑discrimination.

In addition, Article L111-46 of the French Energy Code authorises RTE Réseau de Transport d’Electricité to participate in the identification and the analysis of any action proposed to be taken to control electricity supply, to the extent that such action may encourage a balance of supply and / or demand.

Shareholders

CTE is owned as follows:

owned by EDF

owned by Caisse des Dépôts

et consignations

owned by CNP Assurances (including CNP Retraite)

Below is a diagram describing the shareholding of CTE:

About EDF

A major player in the energy transition, the EDF Group is an integrated energy company present in all business lines: generation, transmission, distribution, energy trading, energy sales and energy services. The EDF Group is a world leader in low-carbon energies, having developed a diversified production mix based mainly on nuclear and renewable energies (including hydroelectricity). It is also investing in new technologies to support the energy transition. EDF’s raison d’être is to build a CO2-neutral energy future that reconciles preservation of the planet, well-being and economic development, thanks to electricity and innovative solutions and services.

About Caisse des Dépôts et Consignations

Caisse des Dépôts and its subsidiaries form a public group, a long-term investor in the public interest and local economic development. It has five areas of expertise: social policies (retirement, vocational training, disability, old age and healthcare), asset management, monitoring subsidiaries and holdings, corporate financing (with Bpifrance) and Banque des Territoires.

About CNP Assurances

The CNP Assurances group is a leading player in personal and property insurance in France, Europe and Brazil. Life insurance, retirement, loan insurance, provident insurance, health insurance, property and casualty insurance… CNP Assurances responds to the many changes affecting the lives of its customers. CNP Assurances acts according to its raison d’être for an inclusive and sustainable society, providing the greatest number of people with solutions that protect and facilitate all life’s journeys.

Composition of the Board of Directors

The composition of the Board of Directors of the company as of June 4, 2025 is as follows

- Ms. Louise Vilain, Chairman and Chief Executive Officer

- M. Paul Bizot-Espiard, Director

- Ms. Corinne Delaye, Director

- M. Alexandre Pieyre, Director

- Ms. Anne-Laure Schnabele, Director

- M. Dimitri Spoliansky, Director

- Ms. Virginie Tant, Director

- M. Grégory Trannoy, Director